ESG reporting in the real estate industry - why ESG is important for real estate developers and investors

30 August 2022

ESG reporting discloses the company's sustainable bottom line. The focus on ESG is increasing, and so is the demand for real estate projects where ESG is prioritized.

We take a closer look at how ESG can be put into practice in the real estate sector.

The non-financial annual accounts

ESG reporting can be seen as a kind of non-financial financial statement. Instead of the financial result, ESG reporting focuses on how the company supports a "sustainable bottom line" measured in environmental, social and governance terms. Both the regulatory ESG requirements and the increasing political and public awareness of ESG focus areas naturally lead to a growing demand for ESG-prioritised projects and buildings.

But what does ESG actually mean in relation to the property industry, and how can you as a developer or investor establish an ESG objective and work with ESG in the various project phases?

What does ESG reporting mean for the construction and real estate sector?

ESG is a concept that is approached differently depending on the sector and the specific project. When we talk about ESG in relation to the individual property or real estate project, the focus is mainly on the environmental and social aspects on which we can have a positive impact as architects and building consultants. That said, ESG reporting is conditional on a sound data base and here the governance dimension is crucial. The company behind the property must ensure a structure that makes the relevant data available so that it can be evaluated here and now and its development measured.

E for environment

Typically, the E is associated with the building's climate footprint. This includes the building materials, the construction process itself and the subsequent operation, but also climate proofing, which is becoming increasingly relevant as the impacts of climate change become more apparent. This is a complex equation that ideally needs to be worked out over the lifecycle of the building, and requires us as architects to think long-term and create robust architecture that can adapt to the new challenges, demands and technical possibilities that are sure to come but that we do not know today.

S for social

The S, the social part of ESG, includes wellbeing and health. In the case of a residential building, this naturally includes the residents and the neighbourhood that the building affects. The conditions of the workers on site during the construction phase and even the conditions where the materials for the building are produced can also be taken into account, if possible. Labelling schemes such as FSC, Nordic Swan Ecolabel or EU Ecolabel can be helpful.

It is an often overlooked point that a socially successful project as a side benefit will result in a reduced carbon footprint because it has a positive impact on parameters such as turnover in tenants or owners, the need for refurbishment and ultimately the lifetime of the building.

G for governance

If you want to talk about G for governance, the focus is on diversity, inclusion and culture in relation to the ownership and property management circle. At the same time, the governance dimension is also crucial for establishing an ambitious sustainability strategy and enabling well-founded ESG reporting.

So we have a definition of E-S-G in place, but how do you ensure and document that your own assets support your company's ESG objectives? We look at this in more detail in the next section.

How to measure ESG?

ESG can seem like a broad and intangible concept, where, like CSR (Corporate Social Responsibility), it is up to the individual company to define strategy and objectives, as well as how to measure progress. This makes it difficult for investors and other stakeholders to assess and compare the property or project.

Therefore, it's important that you make your ESG methodology visible so that your stakeholders know what you are measuring and how. In the following, we present some suggested frameworks and tools for assessing ESG that can be used either alone or in combination and can also help you structure your ESG report. Which solution is right for you depends on your organisation, your market(s) and your investors.

"European Sustainability Reporting Standards" on the way

As part of the Corporate Sustainability Reporting Directive, the EU has agreed to tighten ESG reporting requirements, and to whom they apply, from 2024. EFRAG for the EU is developing concrete "European Sustainability Reporting Standards" to provide guidance. You can see first draft of the ESRS and the public consultation process here.

Until they are ready, you will have to develop your own standard. Below are some ideas for tools and concepts you can use.

ESG benchmarking tools

There are various ESG benchmarking tools on the market that make it easy for you to document and evaluate your projects. By using a recognised tool, you get a clear roadmap to achieve ESG compliance and an independent evaluation with a score that is easy to communicate and understand.

Many of our customers use LEED or GRESB, but there are several other good alternatives that target the real estate industry; for example Energy Star and Ecore. You may want to investigate what is most used and recognised among your stakeholders or what tool best supports the evaluation of your organisation's ESG objective.

Start with an ESG objective

If you do not yet have an ESG objective, the EU taxonomy or the UN SDGs can give you an overview of possible focus areas. Choose targets and sub-targets that are realistic for you to support and set out a plan for how. The objectives and plan can easily be developed on an ongoing basis, as opportunities change and you learn from your experiences.

Here you will find a brief introduction to the EU taxonomy and the UN Sustainable Development Goals, including links to more in-depth resources targeted at the construction and real estate industry.

EU taxonomy - follow the sustainability criteria

The EU taxonomy is a green classification system that translates the EU's environmental and climate ambitions into concrete, common sustainability criteria. Using EU taxonomies helps businesses and investors choose the types of economic activity that contribute to at least one of the EU's climate and environment objectives, while not negatively affecting others.

In this way, the taxonomy is intended to promote green development and counteract green-washing. Criteria have been developed specifically for the construction industry and you can download the Danish Standard's free introduction to the EU taxonomy for the construction industry here.

Net Zero - use the World Economic Forum's 10 principles for green building

An increasing number of companies are committing to carbon neutrality within a given number of years.

Net Zero can be your guide to the essential environment part of ESG reporting and make visible to you which of your activities are hampering your green ambitions or how you can compensate for unavoidable carbon emissions through other measures.

The World Economic Forum has published this guide with 10 principles and an accompanying action plan to help real estate players achieve net zero targets in their property portfolios.

Sustainable Development Goals - the 17 SDGs laid out for the construction industry

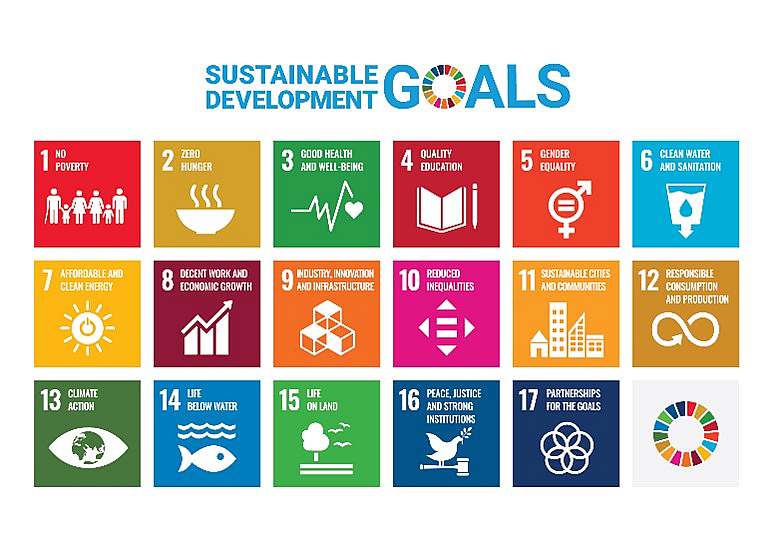

The SDGs are 17 specific goals divided into 169 targets that UN member states have committed to achieving by 2050 to support sustainable development in the world. The goals range from the basics, such as ending hunger and poverty, to goals on sustainable energy, health and well-being, sustainable cities, decent jobs and economic growth. You can see all goals, targets and indicators here.

The Architects' Association and the Builders' Association have developed a dialogue tool that guides the user through all 17 SDGs with the possibility to set strategic goals, sub-goals and criteria where it makes sense. Use the world goals barometer.

ESG Software

ESG software helps companies automate data collection, manage the reporting framework for ESG initiatives and report.

There are a multitude of different options on the market. Which one is right for you depends on your organisation and actions to keep track of.

Measurabl and BuildingMinds are two concrete software solutions for ESG data collection that are widely used in the real estate industry. The solutions can be set up to easily report to, for example, GRESB or CDP, depending on your stakeholders' needs and wishes.

LCA - make a life cycle assessment of your building

LCA stands for Life Cycle Assessment. LCA is a method for assessing the potential environmental impacts and resource consumption associated with a construction project. The life cycle approach shifts the focus from the conditions surrounding the finished building to the whole life cycle of the building. By performing LCAs on all buildings in your portfolio, it becomes easy to compare their sustainability profile and identify where the project can be optimised towards a more sustainable profile, for example by replacing certain materials or production methods. So LCA fits perfectly into an ESG analysis and report, and you might as well get started: In fact, from 2023, LCA calculations will be required for all new buildings. For buildings over 1000 m2 there is a requirement for a CO2 threshold equivalent to 12 kg CO2-eq/m2 /year. You can read more in the national strategy for sustainable construction or see this introduction video.

There are different platforms you can use for LCA calculations. The Danish Agency for Housing and Planning, together with Build at Aalborg University, has developed a platform for LCA calculations that you can use: LCA Construction and One Click LCA is an alternative that also has a module that specifically takes into account the LCA requirements of the Danish Building Regulations.

ESG in the different phases of a real estate investment

It is one thing to have an ESG objective and reporting format, another to translate it into concrete actions in the day-to-day work of the real estate or construction industry. In this section, we look at how you can concretely work towards a stronger ESG profile in real estate investing.

Screening of existing properties

Use your ESG objective as a checklist in your screening of properties or projects. You may be able to rule out a potential investment at this stage, saving your company a lot of time.

We can help you with an effective technical due diligence that also takes your ESG goals into account.

ESG due diligence

If the property qualifies for an actual due diligence, this is where you can delve into the building stock and look at energy consumption, tenancy and the risk of climate-related challenges.

If your company has ESG targets, it may make sense to calculate how the new investment will affect your overall score, if any, and work with your due diligence consultant to define the metrics that are essential for you to meet your target.

Host KHR we have extensive experience with due diligence investigations, and ESG analyses are increasingly becoming part of our service. Some of our customers have developed their own requirements for the content of their ESG due diligence, but KHR can help you with a framework. Similarly, we will work with you to define a reporting format so that you can make the best possible use of our conclusions in your further work.

Regardless of the format, you'll typically receive a comment and/or a risk rating for each focus point. We can assess the cost of correcting deficiencies and making improvements, as well as the estimated savings it will bring within a given timeframe.

ESG in new build projects

You can't avoid making a significant carbon footprint when you build new, but the ESG profile of your project can be greatly optimised if you consider the various parameters from the outset. We would therefore strongly recommend that you ally yourself with a architectural consultantthat can help you choose the best solutions to create an environmentally and socially sustainable project. Precisely because real estate is such a long-term investment, it can really pay to create a good foundation for sustainability in both the short and long term, so that the property - regardless of ownership - will contribute positively to ESG.

Driving a sustainable real estate sector

ESG and the increasing requirements for ESG reporting may be perceived as an additional burden placed on the real estate industry, but it is important to keep in mind that ESG is a major driver for more sustainable development, both environmentally and socially. Real estate accounts for 40% of energy consumption in Denmark and the physical environment has a crucial impact on people's well-being; so the relevance of a greater sustainability focus through ESG, for example, is indisputable.

Let us help you with ESG

At KHR Architecture, we follow developments in ESG requirements, tools and standards in the real estate industry so we can advise you on your specific acquisition or construction projects.

As architects, our focus has always been to create architecture that ensures a long life and a sustainable profile, both functionally, technically and in terms of materials.

Reach out to us, if we are to help you screen, implement ESG due diligence on an existing property or help you create a future-proofed one, sustainable new construction.